Start Your Export-Import Business Now

Fast & Reliable

24/7 Emergency Documentation Services

Licensed & Secure

Get a Free Quote Online

Our Services

Ready to Get Started? Let’s Power Up Your Export-Import Business!

Book Online

Use our easy online form to schedule a service at your convenience.

Call Us 24/7

Need help right away? Call us for emergency services or to get a free quote.

Get a Free Quote

Not sure about the cost? We offer transparent pricing with no hidden fees.

Satisfaction Guaranteed

We guarantee quality work and your complete satisfaction.

24/7 Emergency Services

We’re available around the clock to solve any urgent issues.

FAQ

We've Got The Answers

How to start Export-Import Business?

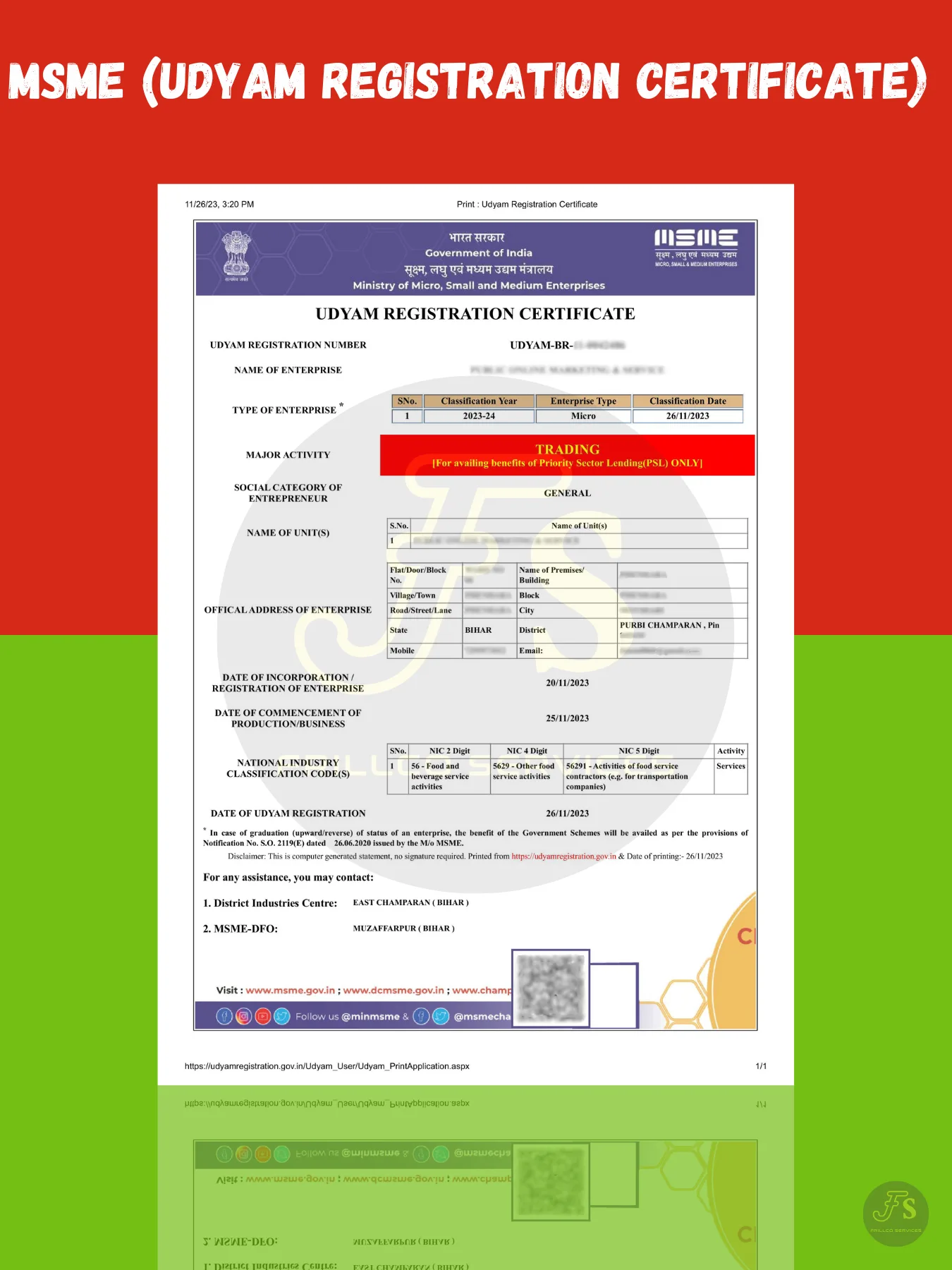

Starting an export-import business in India may seem complicated, but with the right guidance, it becomes a smooth process. Here’s a step-by-step guide to get you started:

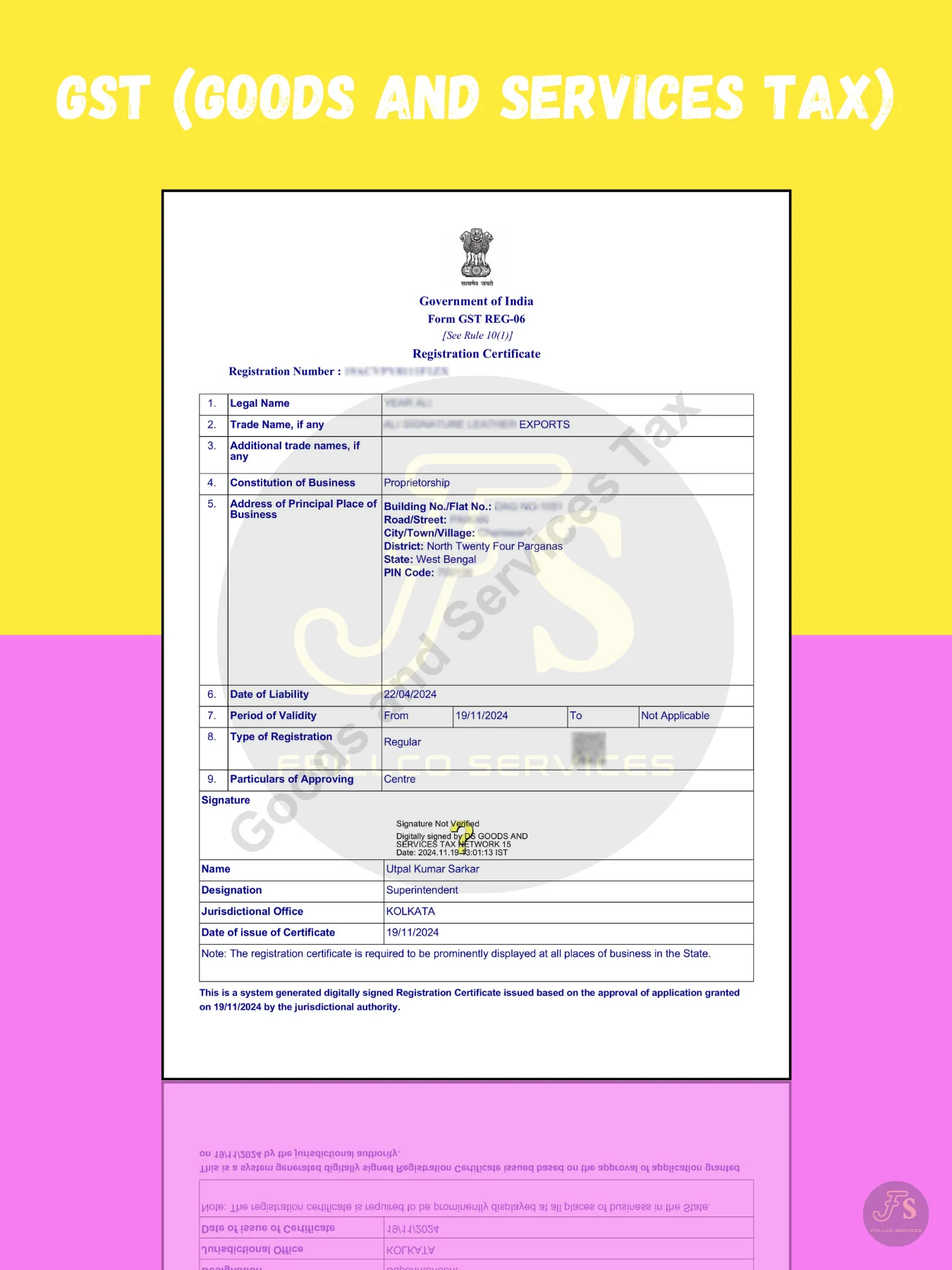

- Register Your Business – First, legally set up your company and obtain GST registration.

- Complete Essential Licensing – Once you have GST, apply for:

- Import Export Code (IEC) – Mandatory for international trade.

- RCMC (Registration Cum Membership Certificate) – Required for export benefits.

- IceGate Registration – For customs clearance.

- AD Code & IFSC Registration – To receive international payments.

- PQMS Registration & Certificate of Origin (COO) – Based on product requirements.

- Find the Right Trade Partners –

- If exporting, connect with trustworthy buyers abroad and ensure secure payment terms.

- If importing, source reliable suppliers and choose the best payment methods.

At Frillco Services, we take care of all legal formalities and documentation, ensuring a hassle-free experience. With a proven track record and a commitment to excellence, Frillco Services is India’s #1 provider in this sector, guaranteeing 100% customer satisfaction.

Let’s get your export-import business up and running today!

How do I find buyers for my export products?

Finding buyers for your export products requires research and strategic outreach. Here are some of the best ways to connect with potential buyers:

- Market Research – First, understand your product well and identify the countries where demand is highest.

- Use Social Media – Platforms like LinkedIn, Facebook, and Instagram can help you connect with international buyers.

- Contact Your Embassy – Many embassies provide valuable buyer data and trade connections.

- B2B Websites – List your products on TradeIndia, Global Trade Plaza, IndiaMART, Alibaba, and other trade portals.

- Attend International Trade Fairs – Networking at trade expos can help you find serious buyers.

- Direct Market Visits – Traveling to international markets lets you meet buyers face-to-face.

- Search Online – Use Google and other search engines to find businesses abroad that deal in your product.

- Reach Out to Buyers – Send emails, make calls, or contact potential buyers on WhatsApp. Follow up regularly to build trust and secure deals.

Pro Tip: Consistency and follow-ups are key to finding the best importers for your product! 🚀🌍

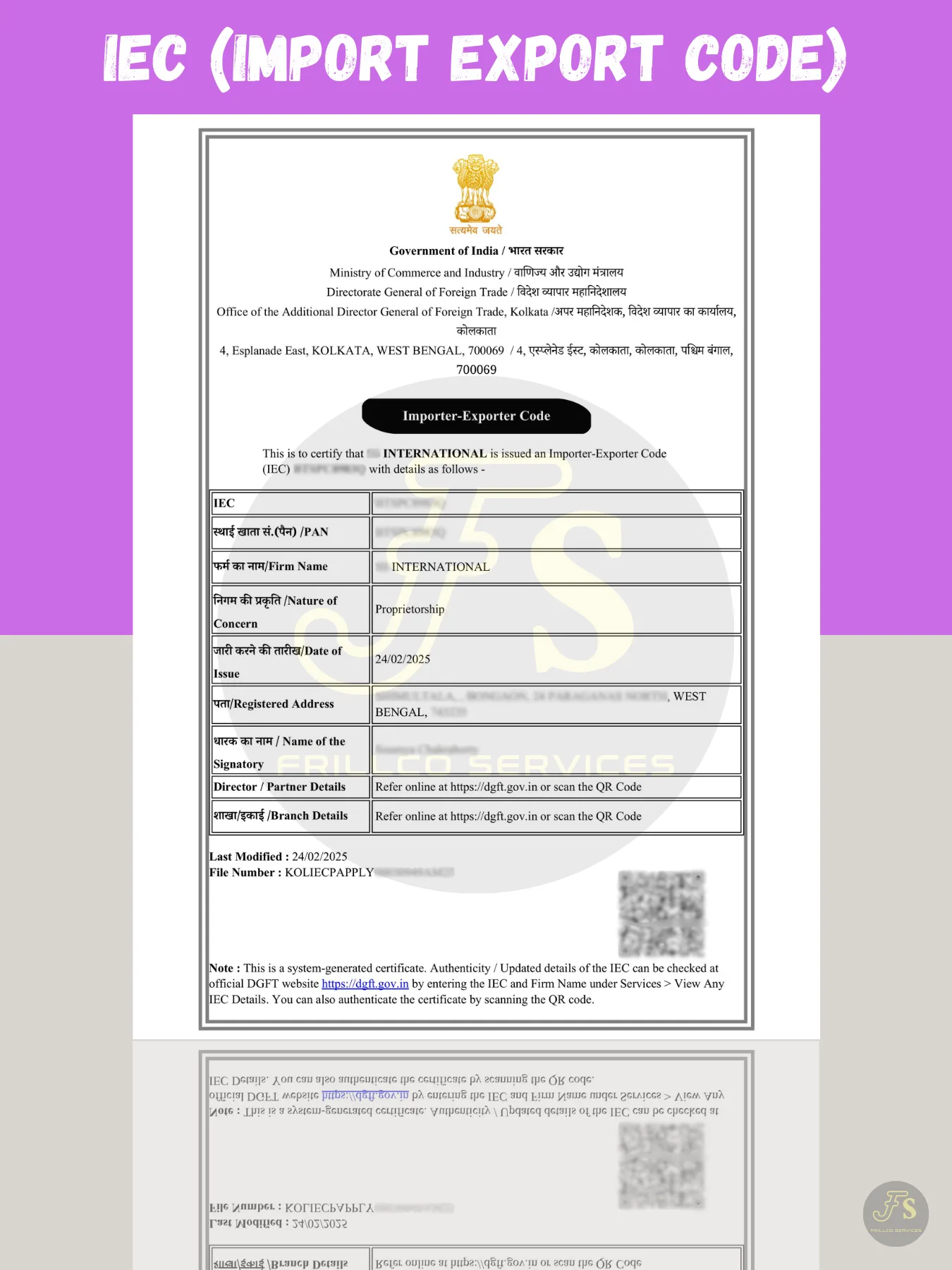

How do I apply for an Import Export Code (IEC)?

The Import Export Code (IEC) is issued by the Directorate General of Foreign Trade (DGFT) and is mandatory for businesses engaged in international trade. Here’s a step-by-step guide to applying for an IEC online:

Step 1: Register on the DGFT Portal

1️⃣ Visit the DGFT website and click on “Register”.

2️⃣ Enter your name, mobile number, email ID, and business address.

3️⃣ Verify your details using the OTP sent to your email and mobile.

4️⃣ After verification, you’ll receive a username and password via email.

Step 2: Fill in the IEC Application

5️⃣ Log in to the DGFT Portal with your credentials.

6️⃣ Click on “Apply for IEC” and enter the required details:

- PAN Number & GST Number

- Business Address & Owner Details

- Type of Exporter/Importer

- Bank Account Details

- Details of Products or Services You Offer

Step 3: Submit & Sign the Application

7️⃣ Attach the necessary documents:

- GST Certificate

- Canceled Cheque

- Partnership Deed (For Partnership Firms)

- Incorporation Certificate (For Pvt. Ltd, OPC & LLP Firms)

- Company PAN (For Partnership, Pvt Ltd, OPC, LLP, Trust, etc.)

8️⃣ Sign the application using Aadhaar-based OTP or Digital Signature Certificate (DSC).

9️⃣ Pay the ₹500 government fee and submit your application.

✅ Your IEC will be generated immediately after successful submission!

Get Your IEC Fast with Frillco Services

Applying for an IEC can be confusing, but Frillco Services makes it quick and hassle-free! We handle all the paperwork, ensuring you get your IEC in record time.

🚀 Frillco Services is India’s #1 IEC Consultant – Contact us today!

Why choose Frillco Services for export-import documentation?

Starting an export-import business can be challenging, especially when it comes to legal documentation. At Frillco Services, we understand the struggles of new and experienced traders, which is why we provide fast, reliable, and affordable solutions to help you get started hassle-free.

What Makes Frillco Services the #1 Choice in India?

✅ Fast & Hassle-Free Process – We complete your export-import documentation in record time, so you don’t have to wait. Our team starts working immediately, ensuring no delays in your business operations.

✅ Industry Experts in Export-Import – Unlike general consultants, we specialize in export-import services, making us experts in this field. Our dedicated team knows the latest legal requirements and compliance rules.

✅ Affordable & Transparent Pricing – We offer services at reasonable prices, making it easy for businesses of all sizes to get started. No hidden charges, just genuine and cost-effective solutions.

✅ 100% Customer Satisfaction – We believe that quality service matters more than just pricing. Our goal is to help Indian exporters and importers compete globally with seamless documentation and compliance support.

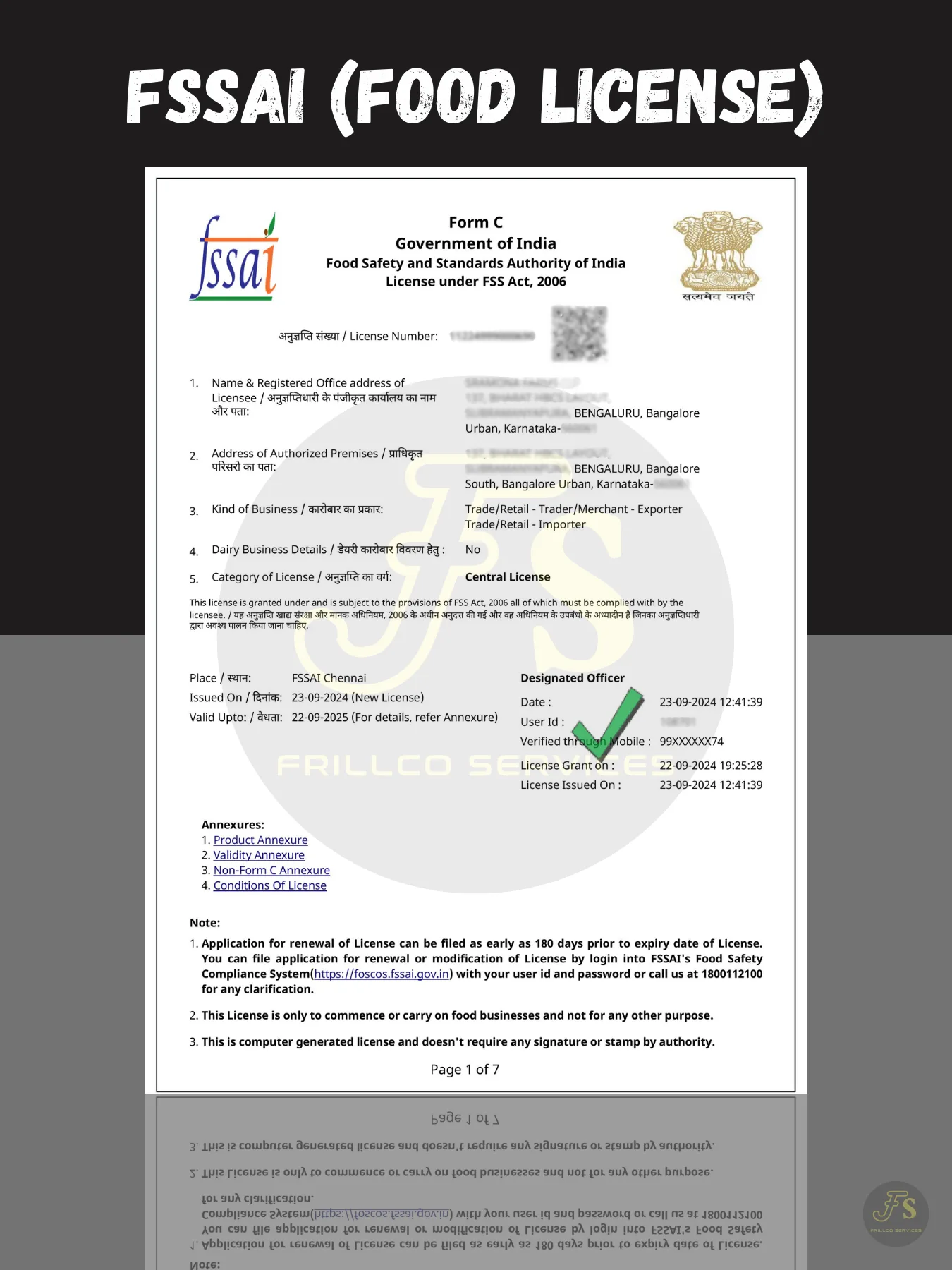

✅ Comprehensive Support for Exporters & Importers – From IEC registration to AD Code, IceGate, IFSC registration, RCMC, COO, FSSAI, and more, we handle all required documentation under one roof.

At Frillco Services, we are committed to making your global trade journey smooth and successful. Let us handle the paperwork while you focus on growing your business! 🚀🌍

📞 Contact Frillco Services Today – India’s #1 Export-Import Consultant!

How long does it take to complete all the registrations?

The time required for export-import registrations depends on whether you want to export, import, or both, and the type of products you deal with. Here’s a breakdown of the registration process and timelines:

Basic Registrations for All Exporters & Importers

✅ GST Registration – Approval time varies as it depends on government processing. This step may take longer based on officer approval.

✅ Import Export Code (IEC) – Frillco Services can get your IEC in just 1 hour!

✅ Port Registration (IceGate, AD Code & IFSC Registration) –

- IceGate Registration – Takes 2-3 working days for officer approval.

- AD Code & IFSC Registration – Applied after IceGate approval, with a total port registration time of approx. 7 days.

Product-Specific Registrations

✅ RCMC (Registration-Cum-Membership Certificate) – Required for exporters, takes 3-4 days for approval.

✅ COO (Certificate of Origin) & PQMS Registration – Frillco Services completes this in just 30 minutes!

✅ FSSAI Registration (For Food Products) –

- Merchant Exporter – Takes 1 day

- Manufacturer Exporter – Takes approx. 15 days

Total Time for Export-Import Registrations

✅ Complete all registrations in approx. 15-20 days (excluding GST registration).

At Frillco Services, we are India’s fastest service provider for export-import documentation, ensuring a smooth and hassle-free process so you can start your international business without delays! 🚀🌍

📞 Contact Frillco Services Today – Get Registered Fast!

What is Port Registration, and Why is it Important for Export-Import Business?

Port Registration is a mandatory process for exporters and importers in India. It includes IceGate Registration and AD Code Registration, both of which are essential for smooth international trade transactions.

Step-by-Step Process of Port Registration

✅ IceGate Registration – The Indian Customs National Trade Portal (IceGate) is managed by the Ministry of Finance. Exporters and importers must register on IceGate using their IEC (Import Export Code) and GST details to access customs clearance and online documentation.

✅ AD Code Registration – The Authorized Dealer (AD) Code is issued by your bank and is necessary for receiving international payments. Once you receive the AD Letter from your bank, it must be registered with customs to authorize export-import transactions.

Why is Port Registration Important?

- ✅ Mandatory for Export-Import Business

- ✅ Required for Customs Clearance & International Transactions

- ✅ Ensures Seamless Money Transfers for Global Trade

Get Port Registration Done Fast with Frillco Services!

Frillco Services simplifies the entire process, handling IceGate and AD Code registration quickly and efficiently. We offer the fastest and most affordable service in India, ensuring you can start your export-import business without delays!

📞 Contact Frillco Services Today – Get Registered Hassle-Free! 🚀🌍

Ready to Get Started Your Export-Import Business? Let’s Start With Frillco Services!

Contact us today for a free consultation or to schedule your service. Our team is ready to help with all your Export-Import business needs.